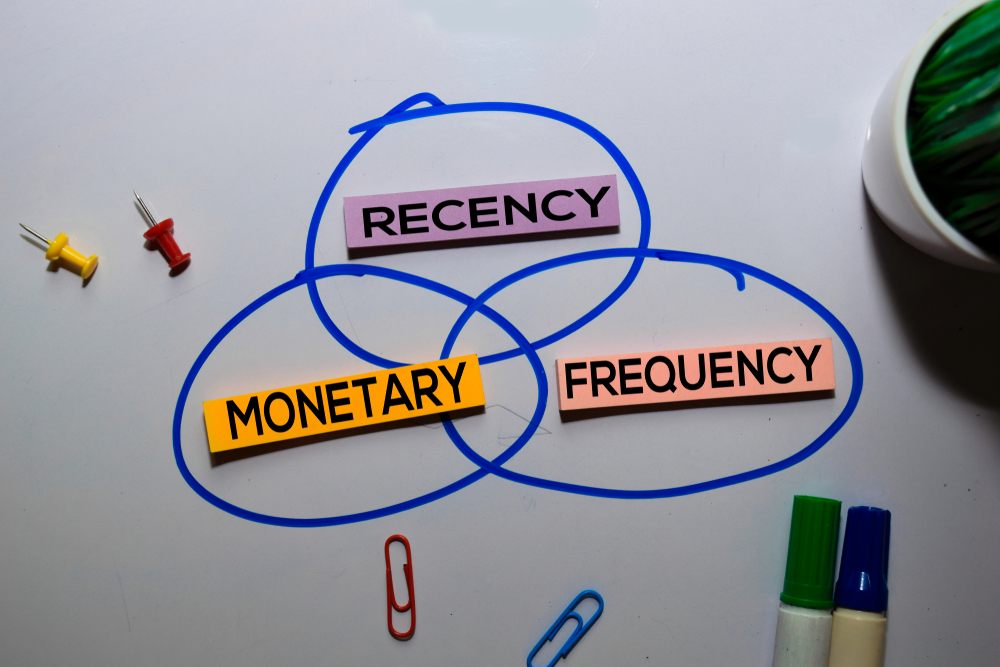

It is quite clear that to be continually successful in the fast changing face of business, one has to understand the customers and meet their needs. For that purpose there is the RFM (Recency, Frequency, Monetary) analysis; an effective way which helps businesses to obtain a great amount of information about the customer.

What is RFM Analysis?

RFM analysis is a customer segmentation technique that examines three critical aspects of a customer’s purchasing history: The last, frequency and monetary value which is the key indicator of the business. Through these three variables it is possible to understand how the customers interact with the content and marketers can adjust their strategies accordingly.

Recency:

The Freshness Factor Recency looks at how long it has been since a given customer transacted with a business, visited a given website, or interacted with a business in any way possible. Customer activity closer to the present time will be more valuable than the ones done in the past. When consumers have had a recent contact with the business, they become more attentive, likely to order frequently, and likely to respond to the marketing communication.

Frequency:

The Loyalty Factor Frequency is the count of the number of times a customer has returned to a business in an agreed time. The groups of consumers exposed to a business more often are often considered to be more valuable and loyal. Hence, they become more inclined towards repurchase, advocacy, and are not easily switchable to adversary firm offerings.

Monetary:

The Revenue Factor Monetary value assesses the total money a customer has spent on a business entity. Loyal customers who have made more transactions are usually more valuable because they bring more business revenue and profitability. Such people are usually your most loyal clients, and usually, you can get the most profit from them, so one should be cautious and attentive with these people.

How to Apply RFM to ABC’s Clients

1. Loyal Customers:

– Recency: They are knowledgeable with current events in the company.

– Frequency: They interact with it all the time.

– Monetary: They incur huge expenses on the company’s services.

– Example:

A large corporation used the service of ABC for over 3 projects within the last one year.

– Strategy:

– Send tailored-package proposals.

– Make them guests of exclusive workshops.

When designing the loyalty program, people should have a possibility for free consultations or get a certain discount.

2. Promising Customers:

– Recency: They have made a recent interaction with the company.

– Frequency: Short contact nature (The subjects have had only two or three interactions).

– Monetary: Moderate spend.

– Example:

A startup engaged with ABC only once.

– Strategy:

Schedule repeat meetings – As much as possible, meetings should follow up on previous meetings so that everyone is on the same page.

– Give coupons for future services.

– Use Same message to show care.

3. Lapsed Customers:

– Recency: Employing the principle ‘out of sight, out of mind’ they have not dealt with the company for quite sometimes now.

– Frequency: Rare engagement.

– Monetary: Low spend.

– Example:

A company went to ABC over a year ago yet it has not come back again.

– Strategy:

– Use in sending re-engagement notifications such as email or messages.

– Make a free consultation offer or have an introductory sale.

– Use examples of best practices in terms of services delivery.

4. Potential Customers:

– Recency: Limited or limited to a certain level:

– Frequency: No frequent interaction.

– Monetary: Low spend.

– Example:

There is a company that listened to a webinar hosted by ABC but the company is not a customer of the company.

– Strategy:

– Free first consultation.

– Ask them to do business networking with him or her.

– Offer one-time commissions.

Outcomes:

With the help of the RFM Analysis, ABC will be aware of the clients who are valuable and provide them with the relevant services which will increase the loyalty, the number of clients that have left during some period, and those who may become valuable clients in the future.

The Udjat Agency Perspective

At Udjat Agency we are convinced that RFM analysis is a valuable tool for any business with a clientele base that has the potential for even greater growth. In light of this, our clients gain the ability to determine the Recency, Frequency, and Monetary worth of their clients in order to make smart business choices, prioritize marketing strategies and secure long-term success.

Many organizations and companies in different industries have sought our ability to assist them in implementing successful RFM segmentation.

Conclusion

Culturally, it is universally true that understanding your customers is where you start and is the key to sustained growth. RFM analysis is a useful tool for enabling businesses to develop good strategies for marketing to their customers, as it gives them considerable insight into the customers’ buying behaviors.

Learn more about Fab model before 2025.

You can also read about The Gap Analysis by Udjat Agency!

Discover What Is The TOWS Matrix In 2025!